The fifth generation of mobile networking technology (5G) is seen as a key enabler for the digital transformation, whereas cloud computing is considered the first. Most industrial companies plan to implement 5G within two years and many consider acquiring their own private licenses. Nearly half of large industrial companies intend to apply for these, according to a study by the Capgemini Research Institute.

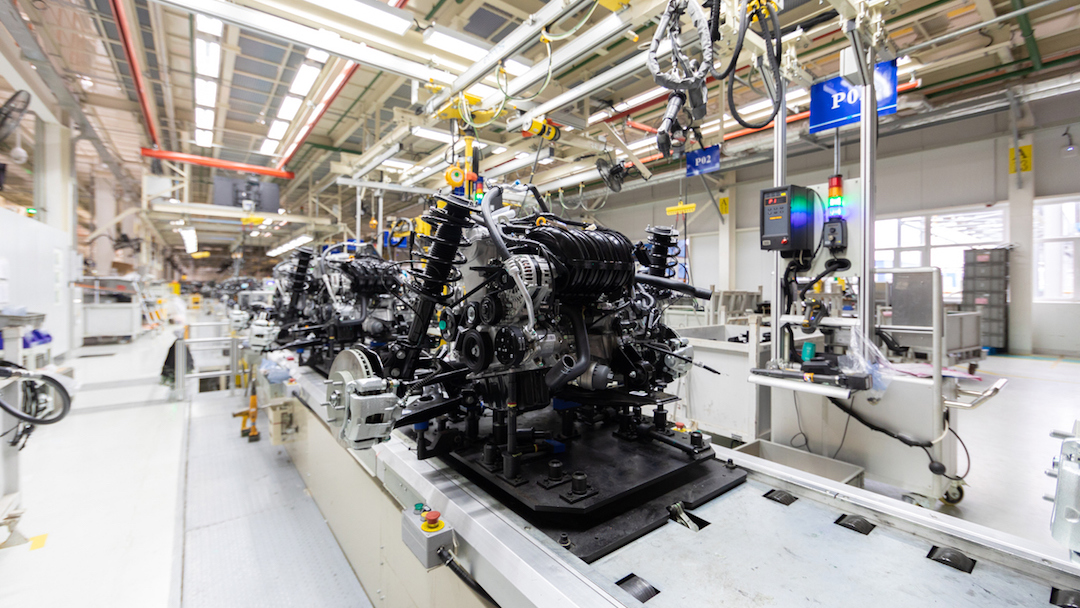

5G is regarded as a catalyst of digital transformation, and manufacturers expect it to deliver more secure and efficient operations. When industrial companies’ executives were asked which technologies will be the most integral to their digital transformation over the next five years, 75% mentioned 5G as a key enabler, ranking second to cloud computing (84%), and ahead of technology innovations such as advanced automation and AI and machine learning. Industrial companies believe that 5G’s versatility, flexibility and reliability will help address connectivity challenges (a limiting factor to digital transformation for 44% of those polled) and fuel future use cases.

Industrial companies want to move quickly to implement 5G: There is widespread confidence in 5G’s potential, with almost two-thirds of industrial companies (65%) planning to implement it within the first two years of availability. In Italy (35%), France (30%) and Canada (27%), over a quarter intend to use 5G within the first year, while 75% of industrial companies in the UK and Italy, 69% in Spain, and 68% in the US and Norway plan to start within the first two years. The largest manufacturers are most likely to implement 5G first compared to the broader industry: 74% with annual revenue above 10 billion dollar expect to do so within the first two years, compared to 57% with revenue between 500 million and 1 billion.

One in three industrial companies are planning to apply for their own 5G license and large organisations will take the lead with 47% expressing interest. This is fueled by a desire for greater autonomy and security combined with concerns about telecom operators being too slow in rolling-out 5G public networks. However, there will be regulatory barriers which differ across countries.

“As a solution provider and a manufacturer, we are monitoring the 5G landscape closely and we believe there are multiple benefits to holding our own license,” says Gunther May, head of Technology and Innovation at Bosch Rexroth AG. It would allow us to be in full control of our 5G strategy by giving us the freedom to either deploy the network alone or with a telecom operator.”

Security and operational advantages will drive 5G adoption as well. When asked about the business reason for investing in 5G, more than half cited more secure operations (54%) and efficiency of operations/cost savings (52%), with the expectation that 5G will help in enabling or enhancing use cases such as real-time edge analytics, video surveillance, remote control of distributed production, AI-enabled or remote controlled motions, remote operations through AR/VR, etc.

Industrial companies will pay more for premium services, the report says. Despite uncertainties around the speed of deployment, manufacturers are already willing to pay a premium charge for enhanced 5G connectivity. 72% of industrial companies will pay more for enhanced mobile broadband speed and increased capacity, yet only 54% of telecom operators think there is appetite for this. This presents an opportunity for telecom operators to consider how they build a highly profitable 5G business model.

“This research makes it clear that industrial companies are confident about the benefits of 5G before it has even come to market,”

says Pierre Fortier, principal consultant in Telecom, Media and Technology at Capgemini Invent. “That said, 5G is an emerging technology and there will be many challenges to overcome before it is ready to be deployed at scale. Co-innovation between industrial companies and the telco ecosystem, in the form of pilots and open experimentation platforms, will be essential to create win-win business, service and operating models that will foster 5G adoption.”

About the research

Capgemini conducted a primary survey of over 800 executives from industrial companies. Respondents were based in Belgium, Canada, France, Germany, Italy, the Netherlands, Norway, South Korea, Spain, Sweden, the UK and the US, and worked across a dozen sub-sectors: aerospace & defense, airport and railway operators, automotive, chemical, consumer products, energy & utilities, industrial machinery, logistics, medical devices, pharma & life sciences and semiconductor and hi-tech manufacturing. The Capgemini Research Institute also conducted a survey of 150 telecom executives from these 12 countries and finished more than 20 one-on-one interviews with industry and telecom executives as well.